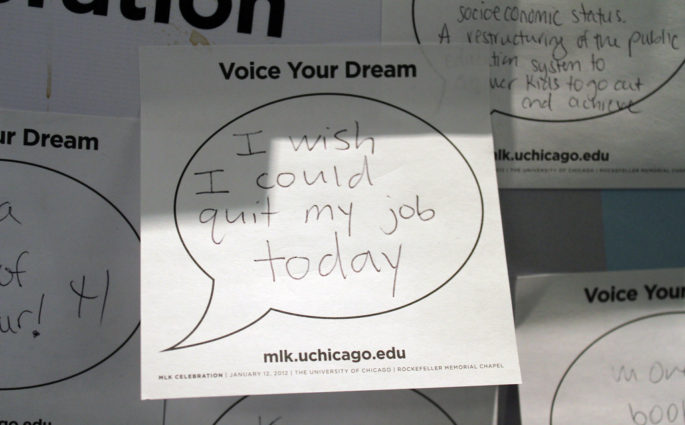

Risk Free Entrepreneur: How To Run A Business When You Already Have a Job

Having a job is all good and well, but if you want to reach the top dollar – and the financial security that goes along with it – then it’s no substitute for starting your own business. The problem isn’t that people don’t have ideas for a business. They have plenty of those. The issue is that they’re already working full time and don’t think they have the time to