How to take control of your debt

Is your debt spiralling out of control? If you’re worried about your debt, there are a number of things you can do to take control this year. By slashing your expenses and making a commitment to pay off as much debt as you can, you’ll be saving yourself hundreds or thousands of dollars in interest.

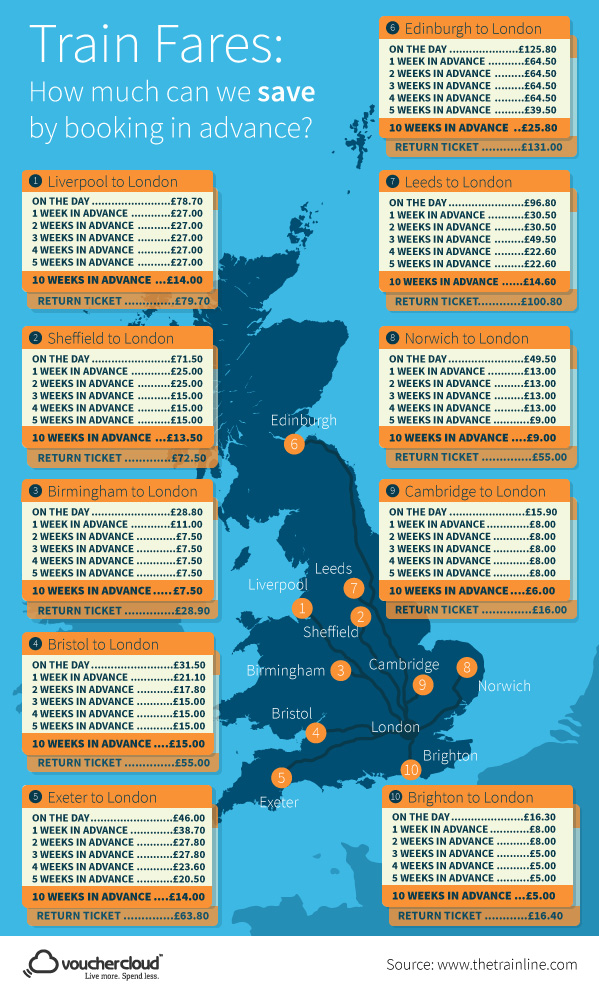

The first step is to examine your spending. There are a number of small ways that you can save a lot of money by thinking smart. A great example is choosing advance train fares instead of buying your ticket on the day. Train tickets increased by 3.5% in January 2015, and they’re also due to increase another 1.9% in 2017.

For people who often need to travel for work, these expenses can make it difficult to find extra money to pay off their debt. But by booking in advance, you can save a lot of money. Here’s an example:

If you buy a single ticket to London from Sheffield on the day you’re planning to travel, you can expect to pay £71.50. Ouch. However, if you know one week in advance that you’ll need to travel that day and you go ahead and buy your ticket, you’ll only pay £25. That’s a saving of more than £45!

And for lucky people who know when they’ll need to travel a couple of months in advance, you can save even more money. If you book that same single ticket 10 weeks before the departure date, you’d only be paying £13.50 for that seat.

That extra money can go straight towards paying off your debt.

Other great ways to save money include using public transport instead of driving to work, which saves on gas and parking costs, taking your lunch to work and eating dinner at home instead of going out or picking up takeaways, and spending time at home hanging out with friends and family instead of going out to socialise.

Paying off your credit cards is usually one of the first steps when you’re aiming to take control of your debt. Credit cards have some of the highest interest rates around and you’ll often find that you’re only making the minimum payment each month. That means you’re only paying the interest payment, and not the actual balance.

Some credit card companies and banks will offer interest-free periods if you switch to their credit card. If you have six months or a year as an interest-free payment period, every time you make a payment you’ll be paying off your actual balance, and will be able to get ahead.

Another option is to speak with your bank about a loan. Many loans will have much lower interest rates than credit cards, so you can consolidate all of your debt with one loan, pay off your credit cards, and then just make payments on your loan each month.

By focusing on small ways to cut your spending and paying off high-interest debt, you’ll be able to make some giant steps forward this year.