Looking to Invest in Property? Here Are 4 Things to Consider

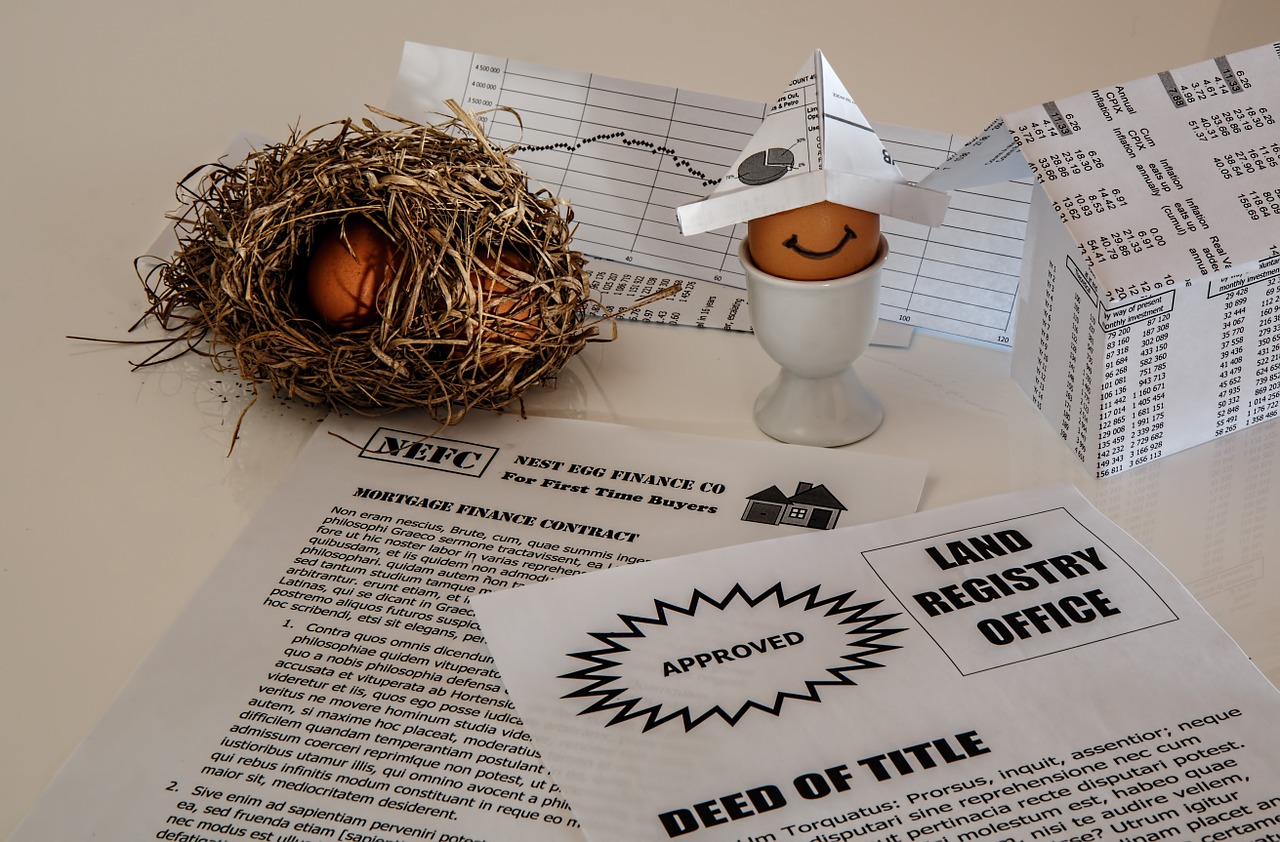

Most people want their hard-earned dollars to do a little of the wealth-creating work for them and, when it comes to investing, property has been a hugely popular way to expand wealth for decades. So, if you’re looking to invest, here are four things to consider.

1. Tax Benefits and Capital Gain

There are a number of positives to purchasing for investment purposes. Not least are some of the tax incentives available. If you have an investment property, the rent it provides is counted as income, but the interest paid on your bank loan is counted as a tax deduction, as are repairs or maintenance conducted at the property and agent’s fees. Meanwhile, new items like stoves and air-conditioners can also be claimed as they depreciate.

As a result, many people get into property investing because they know property value is increasing, there is handy income to be earned here, and there are also tax deductions along the way that can be calculated using a internet tax tool. It’s worthwhile consulting a financial expert to find out the perks and pitfalls.

2. Growth Areas

If you are looking to invest in property, talk to some experts. Some of the greatest capital gains on property are found in growth areas, such as designated growth corridors or suburbs that are just outside the cities where the commute is easy. Property specialists, such as Templeton Property, can give you some great advice on what areas are on the up and have a host of interested renters. For more information about specific ways a property expert could assist you with this, check out this URL.

3. Do Your Research

While you’re assessing preferred suburbs or townships to invest in, do some comprehensive research. It’s worth looking into key demographics like employment statistics, household income, and the average family composition, whether it’s professional couples or single income families. Knowing your demographic allows you to select the right property for potential renters. It also lets you know whether the area is dependent on one industry, such as mining, for income. It’s worth bearing in mind that single industry towns can prove risky; should that industry unexpectedly slump or fail entirely, your investment property could significantly decrease in value. If you’re looking to invest for specific reasons, such as tax breaks, you will want to make sure that you know exactly what you need to do in order to both qualify for the particular break you are looking for and stay IRS compliant. Those looking to defer captial gains tax, for example, might want to look at these 1031 Exchange FAQs to learn about one such way that they can achieve this.

4. Be Mindful of Your Borrowing

With interest rates generally favourable and most financial institutions lightening up on borrowing pre-requisites, it’s tempting to max out your borrowing capacity. However, it’s never clear how long low interest rates might last; what is a dream come true at the moment could swiftly turn into a nightmare if rates start to rise. The best advice is to borrow within your means and provide a little leeway in case conditions change. It’s also wise to pay down the loan as quickly as possible while interest rates are manageable.

Investing in property is popular for a reason. For many people, it has provided a great nest egg that has delivered solid results over time. It’s just a matter of researching carefully and investing within your means. Do you have any tips that could help a soon-to-be investor? Please feel free to share them below!