Your guide to renting, what you need to know

Whether you’re a tenant or you own a property, there are unique challenges that you’ll be facing along the way.

Luckily, Homelet has some great advice for both landlords and tenants, so everyone is on the same page and aware of their rights and responsibilities.

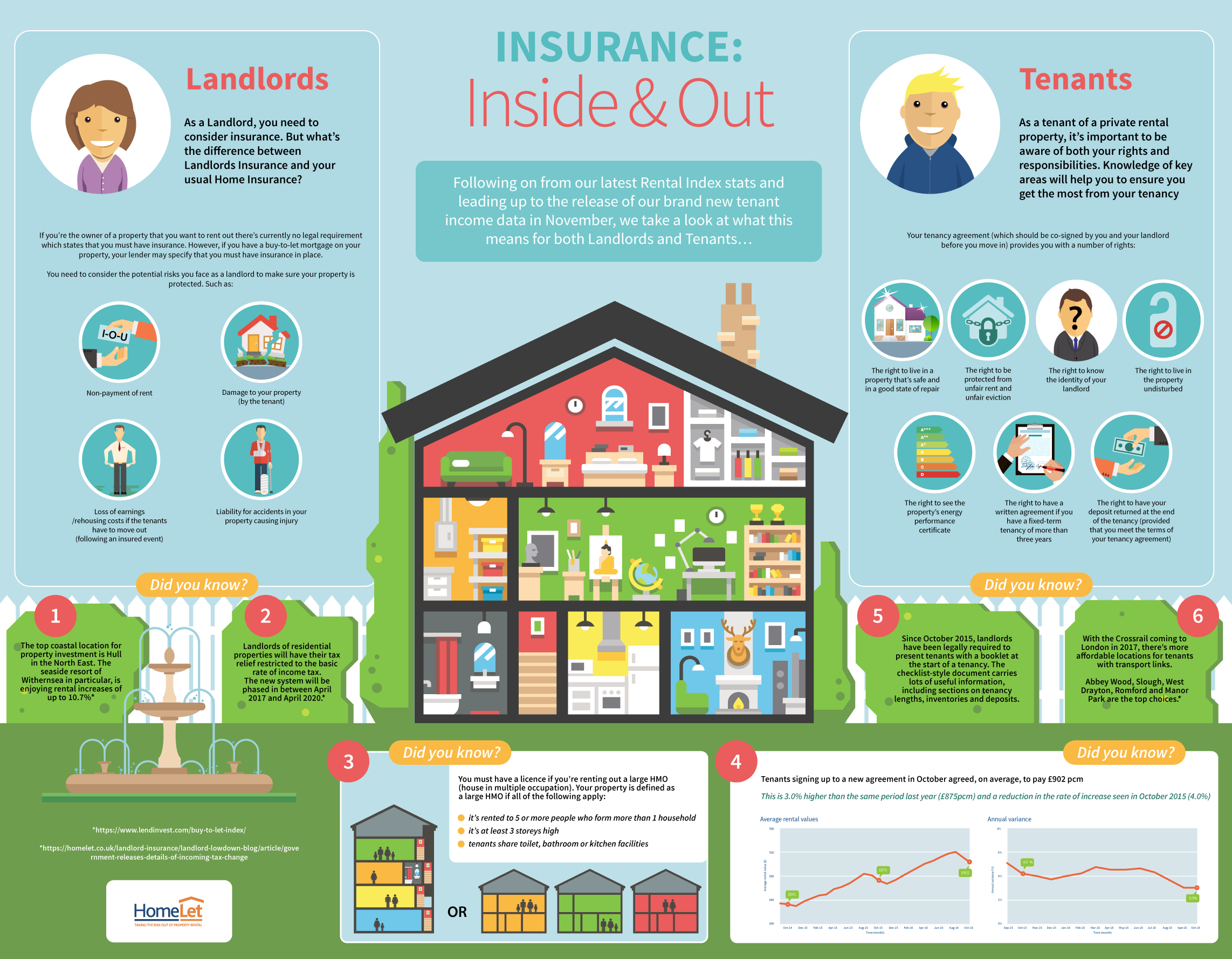

As a landlord, when you’re renting out your property you’ll need landlord’s insurance, and many people are unaware of the difference between this and regular home insurance. If you own the property outright, you don’t legally need insurance (although it’s smart to have it), however if you have a mortgage you can expect your bank or lending institution to tell you that you must have landlord insurance.

For tenants, you also need to know your rights and responsibilities when you’re renting a property. Before you actually move in, you need to ensure that your tenancy agreement has been signed by both your landlord and yourself. The tenancy agreement is crucial, since it gives you many different rights, such as the right to life in a property that’s in a good state of repair and also safe. It also prevents you from rent hikes or unfair rent, along with unfair eviction. You also are given the right to live in the property undisturbed (landlords can only visit with prior notice and permission), and you also have the right to know who your landlord actually is.

Your tenancy agreement also gives you the right to take a look at the property’s energy performance certificate, which can help you decide which appliances to use, and what you can expect from your energy company. For those who have a fixed-term tenancy for three years or more, you should also have been given a written agreement, which says that you’ll receive your deposit back when your tenancy has ended (as long as all the terms in the tenancy agreement have been met.

With rents continuing to increase, it’s important that landlords and tenants understand their rights and responsibilities, so that both parties know where they stand and what they can expect from the other party.

For tenants, it’s helpful to know if your landlord has landlord’s insurance, and landlords will find that they have greater piece of mind and feel more comfortable knowing that they’re covered in the event of an emergency.

A good landlord insurance will cover you for contents and building protection, legal expenses, and emergency assistance protection. You’ll find that he best policies are able to be tailored to your needs, particularly if you own multiple properties.

For those renting, it’s also important to make sure that you’re covered as well. It can be a good idea to ensure that you have your own insurance for your belongings, and many people also choose to get insurance so that they’re covered for their rent payments in the event that they suddenly can’t work.

As you can see, there are a number of things that you should be aware of, whether you’re renting or you own a property.